| area_scope | areas | months | start_month | end_month | analysis_lookback_months | report_lookback_months | repossession_start_month | repossession_end_month | repossession_areas |

|---|---|---|---|---|---|---|---|---|---|

| regions_and_countries | 14 | 36 | 2022-12 | 2025-11 | 36 | 12 | 2016-05 | 2025-09 | 11 |

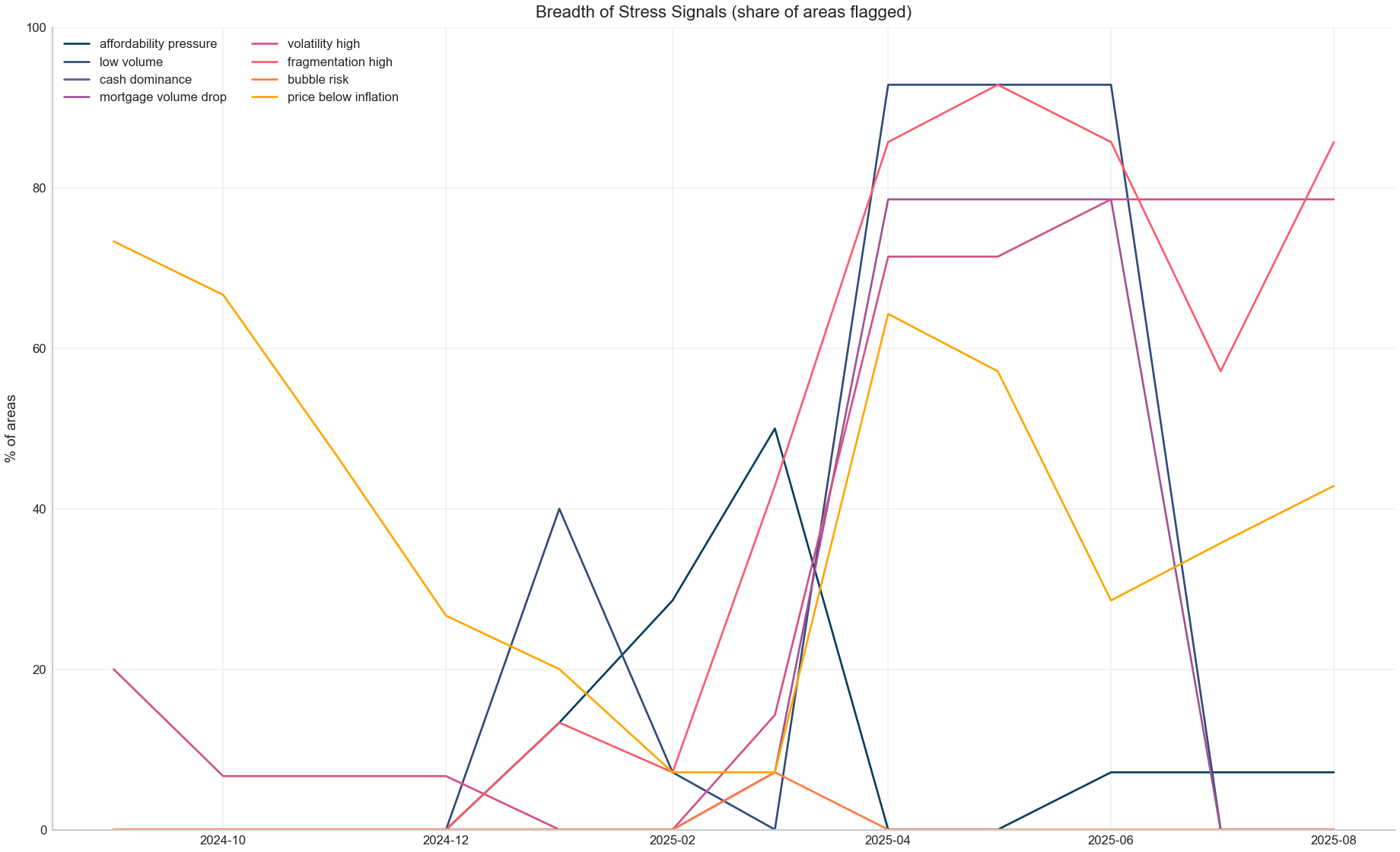

| signal | rule | interpretation |

|---|---|---|

| affordability pressure | affordability_pressure >= 2.0 | FTB price growth is materially above the wage growth proxy. |

| low volume | liquidity_stress >= 0.80 | Sales volume is in the bottom part of the area's history (thin market). |

| cash dominance | cash_dominance >= 0.60 or cash_dominance_hist_pct >= 0.80 | Cash share is high; can indicate mortgage constraints or cash-led pricing. |

| mortgage volume drop | mortgage_volume_drop >= 10.0 | Mortgage transaction activity is falling sharply year-over-year. |

| volatility high | volatility_hist_pct >= 0.80 | Monthly price changes are unusually unstable for that area. |

| fragmentation high | fragmentation_hist_pct >= 0.80 | Property types diverge unusually (segmented market). |

| bubble risk | bubble_risk_z >= 2.0 | YoY growth is unusually high vs long-run baseline for that area. |

| price below inflation | pct_12m < 3.0 | Price growth is below the inflation proxy (real-terms decline risk). |

| period | metric | latest_month | latest_value | stress_percentile | meaning |

|---|---|---|---|---|---|

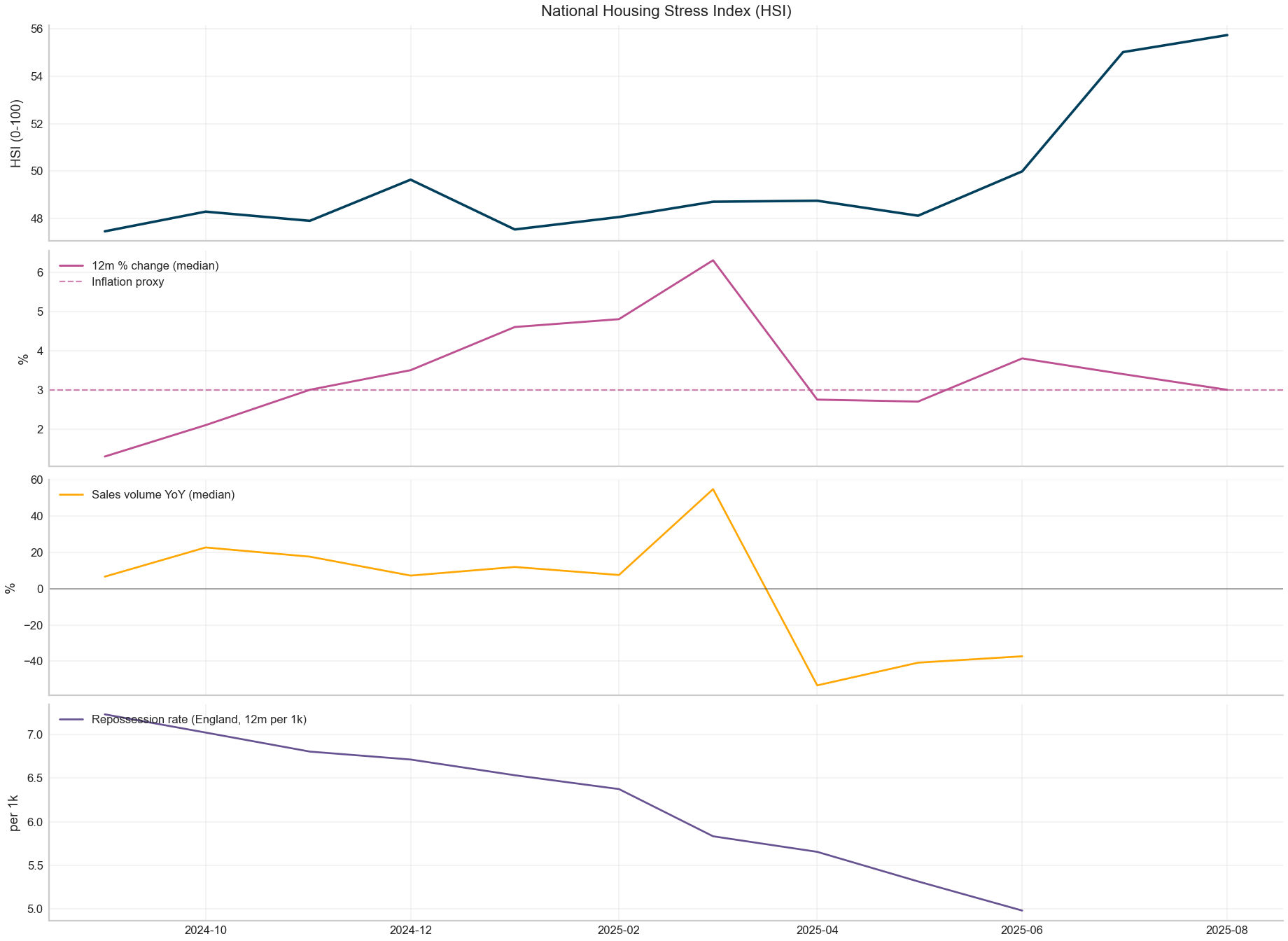

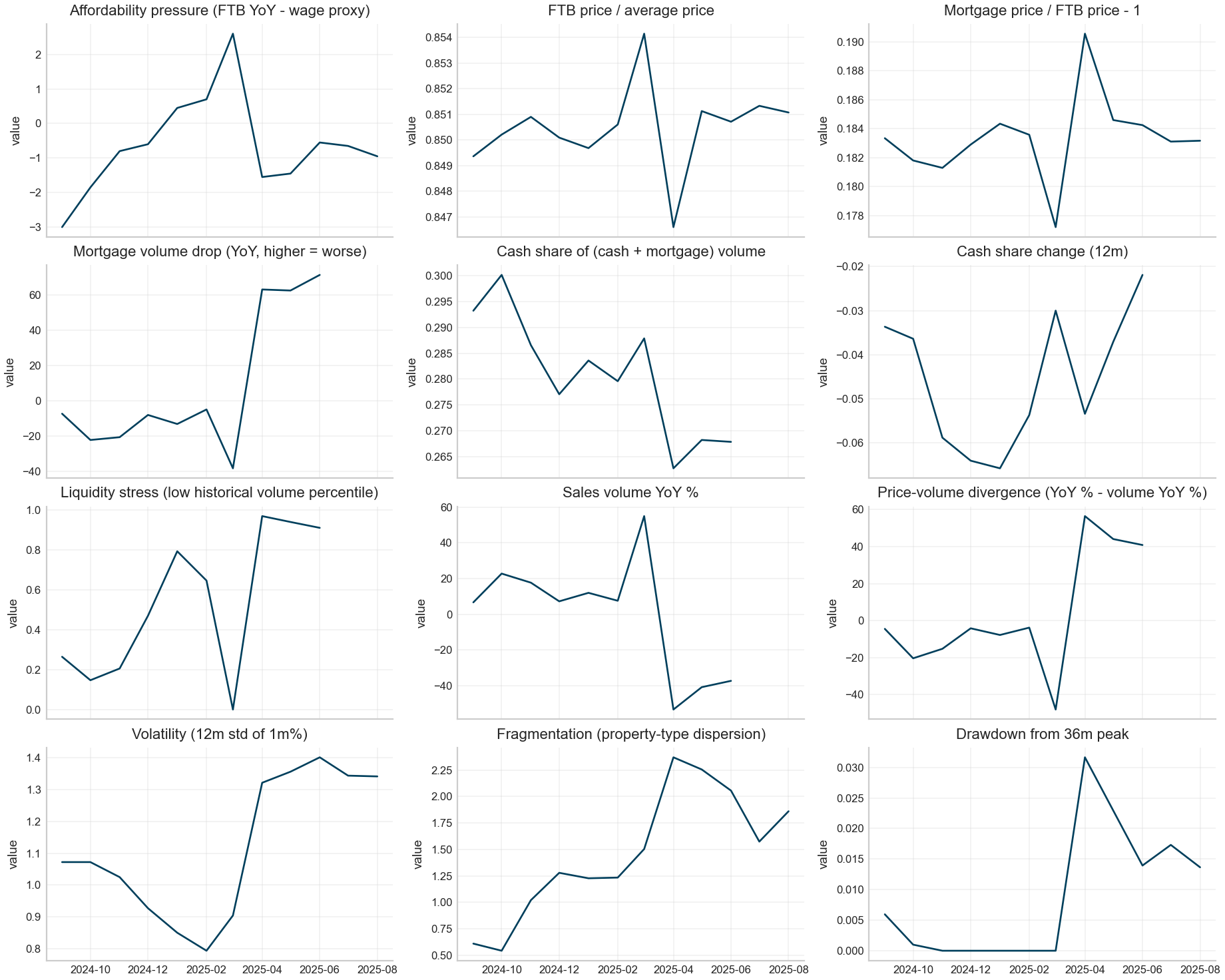

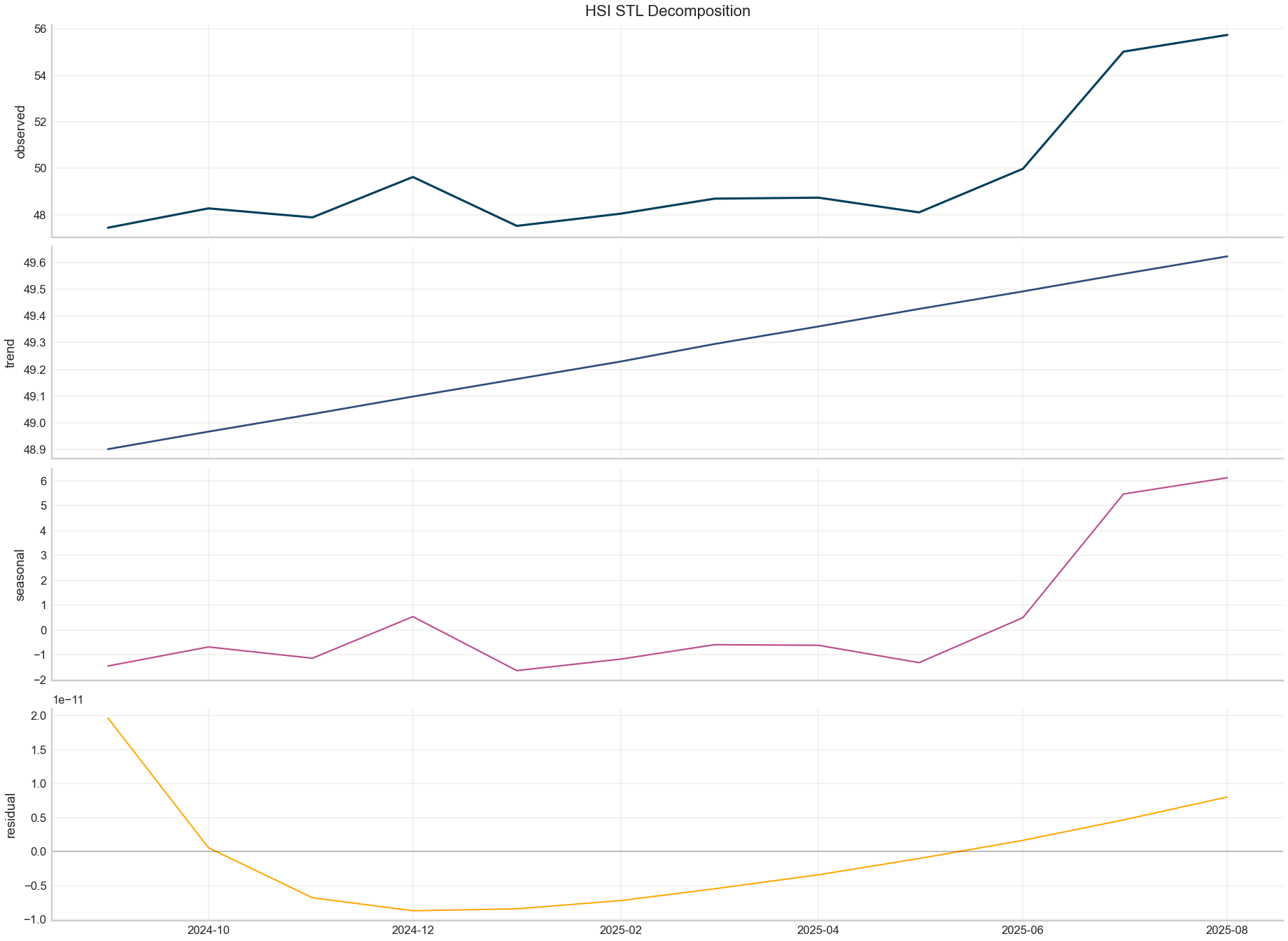

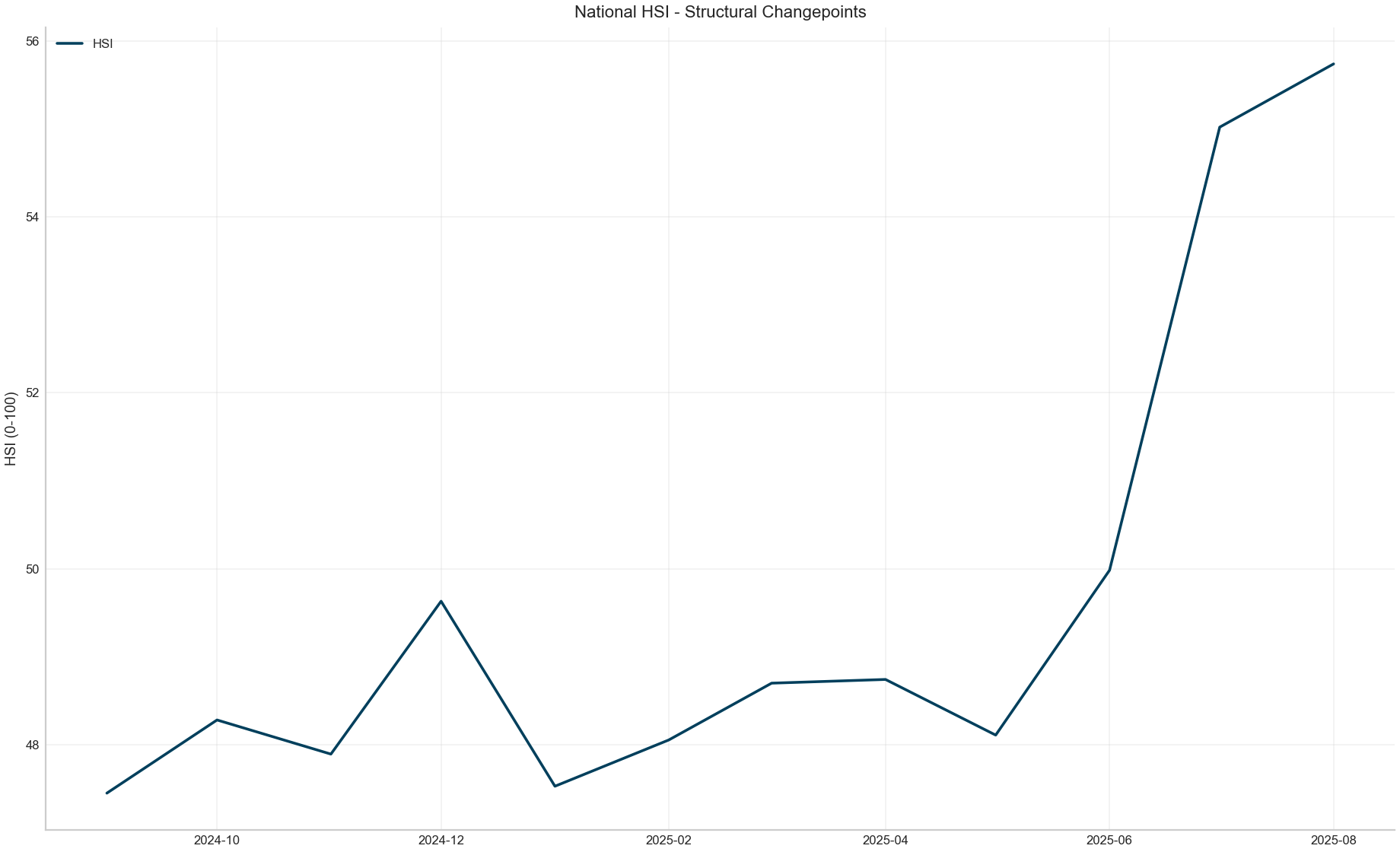

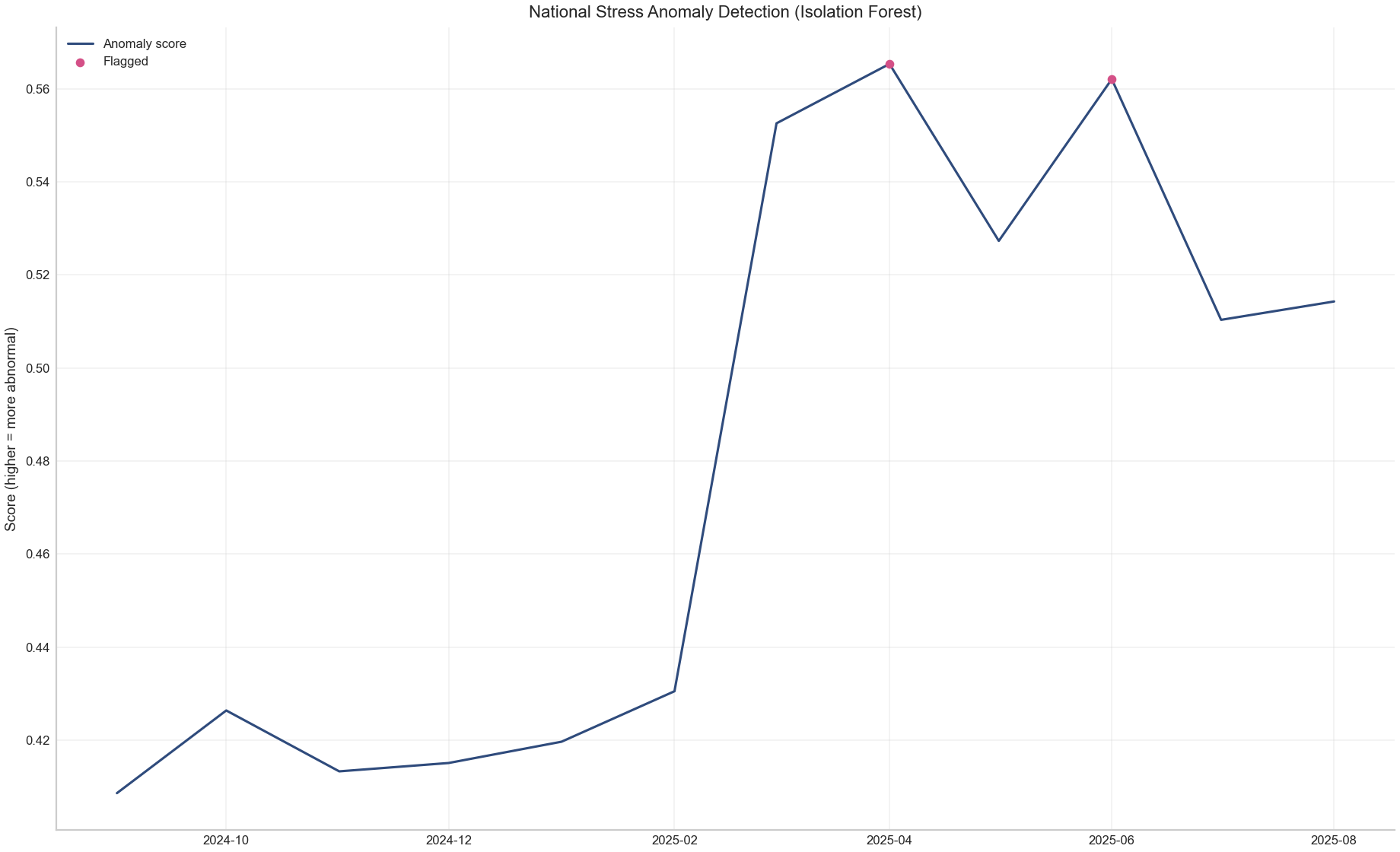

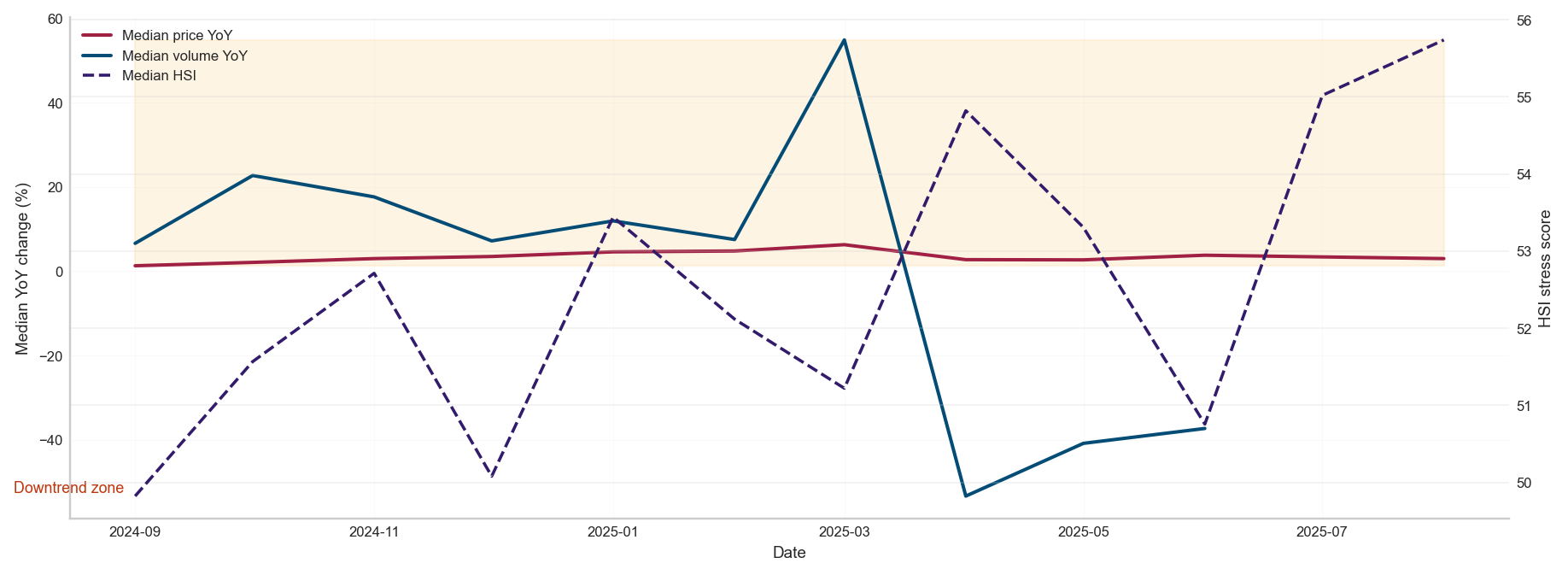

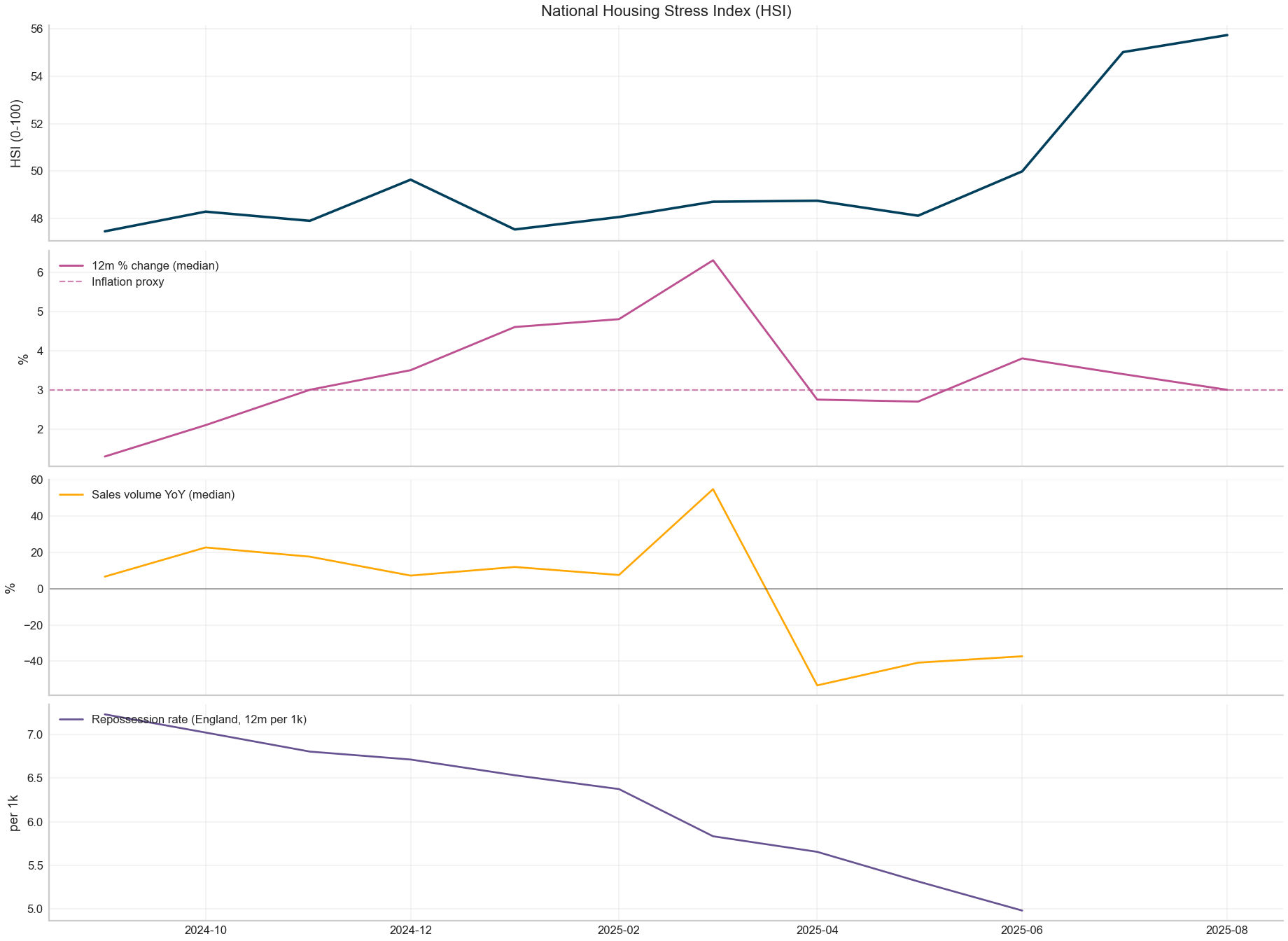

| 2022-12 to 2025-11 | HSI (national) | 2025-11 | 52.864 | 86.111 | Composite stress score (0-100). Higher means more stress. |

| 2022-12 to 2025-11 | Price YoY (median) | 2025-11 | 2.350 | 37.500 | Low (below inflation) can indicate real-terms declines. |

| 2022-12 to 2025-11 | Sales volume YoY (median) | 2025-09 | -33.257 | 90.909 | Falling volumes indicate a thinner market and harder financing. |

| 2022-12 to 2025-11 | Cash dominance (median) | 2025-09 | 0.271 | 17.647 | High cash share can mean mortgage market stress or cash-driven pricing. |

| 2022-12 to 2025-11 | Volatility (median) | 2025-11 | 1.384 | 90.909 | Higher volatility means more unstable monthly pricing. |

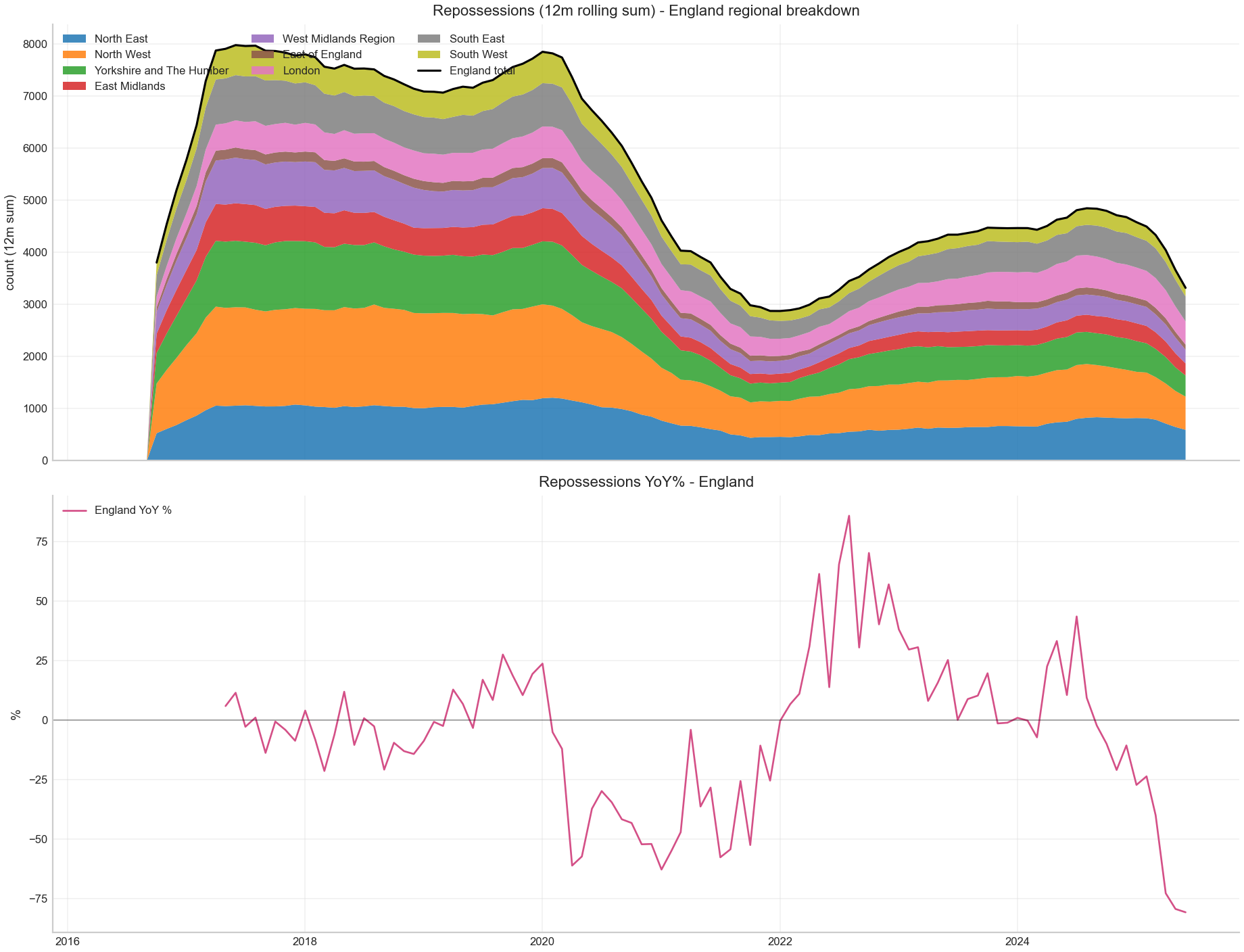

| 2022-12 to 2025-11 | Repossession rate (England, 12m per 1k) | 2025-09 | 5.587 | 3.448 | Higher means more repossessions per 1k sales (12m rolling sums). |

| 2022-12 to 2025-11 | Repossessions YoY% (England) | 2025-09 | -82.793 | 2.941 | Higher means repossessions are rising faster year-over-year. |

| 2022-12 to 2025-11 | Affordability pressure (median) | 2025-11 | -1.850 | 58.333 | FTB price growth above wage proxy; higher means harder for new buyers. |

| 2022-12 to 2025-11 | Mortgage volume drop (median) | 2025-09 | 74.993 | 100.000 | Higher means mortgage transaction activity falling faster (YoY). |

| 2022-12 to 2025-11 | Fragmentation (median) | 2025-11 | 1.363 | 75.000 | Higher means property types diverge (segmented market). |

| Date | signal | share_pct |

|---|---|---|

| 2025-11 | volatility high | 64.286 |

| 2025-11 | price below inflation | 64.286 |

| 2025-11 | fragmentation high | 28.571 |

| 2025-11 | affordability pressure | 7.143 |

| 2025-11 | low volume | 0.000 |

| 2025-11 | cash dominance | 0.000 |

| 2025-11 | mortgage volume drop | 0.000 |

| 2025-11 | bubble risk | 0.000 |

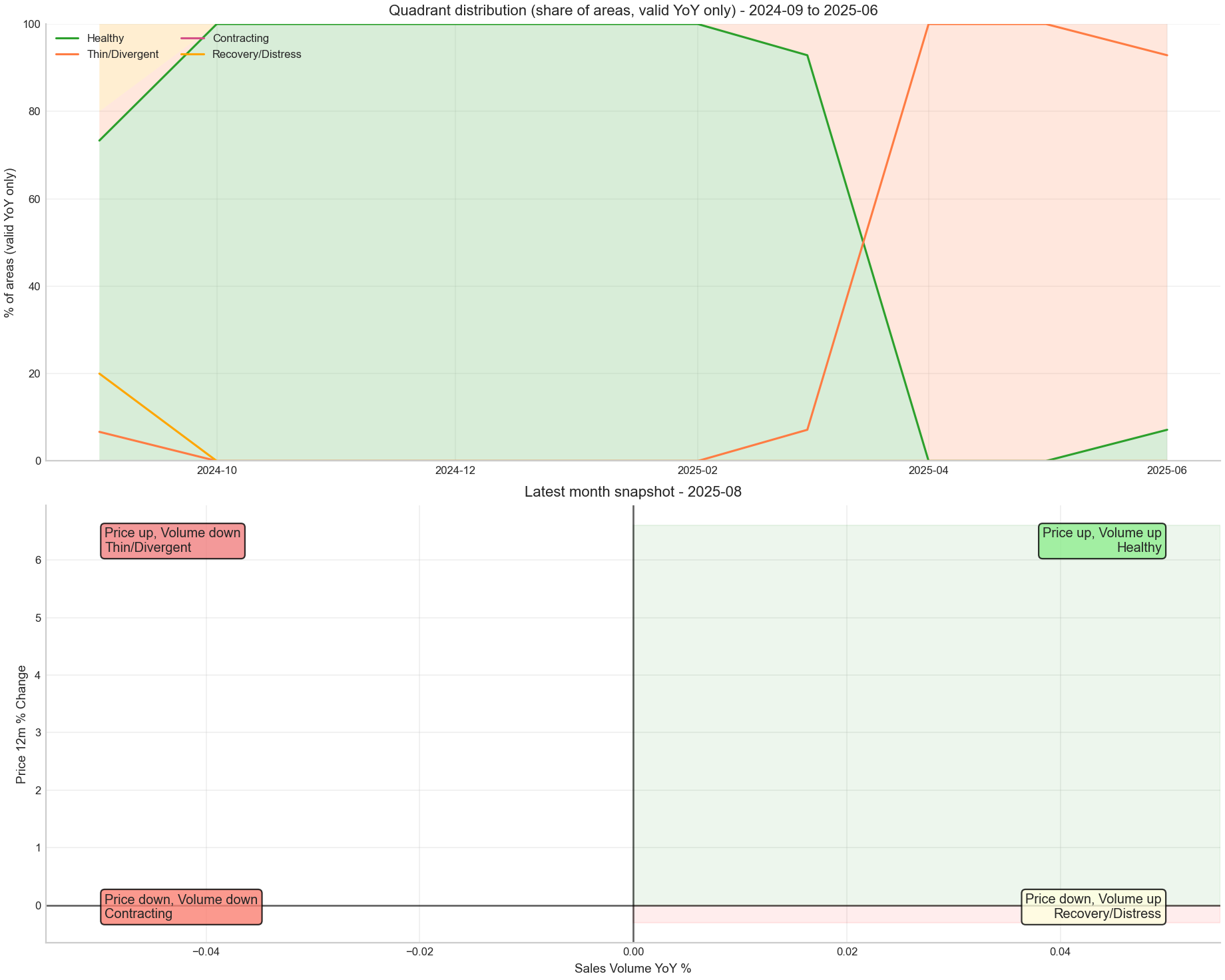

| AreaCode | RegionName | start_quadrant | end_quadrant | quadrant_switches | valid_months | dominant_quadrant | dominant_share_pct | healthy_share_pct | thin_divergent_share_pct | contracting_share_pct | recovery_distress_share_pct |

|---|---|---|---|---|---|---|---|---|---|---|---|

| E12000007 | London | Healthy | Contracting | 2 | 10 | Healthy | 40.0 | 40.0 | 40.0 | 20.0 | 0.0 |

| E12000009 | South West | Healthy | Thin/Divergent | 2 | 10 | Thin/Divergent | 50.0 | 40.0 | 50.0 | 10.0 | 0.0 |

| S92000003 | Scotland | Healthy | Healthy | 2 | 10 | Healthy | 70.0 | 70.0 | 30.0 | 0.0 | 0.0 |

| E12000004 | East Midlands | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E12000006 | East of England | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E92000001 | England | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E12000001 | North East | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E12000002 | North West | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| N92000002 | Northern Ireland | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E12000008 | South East | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| K02000001 | United Kingdom | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| W92000004 | Wales | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E12000005 | West Midlands Region | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| E12000003 | Yorkshire and The Humber | Healthy | Thin/Divergent | 1 | 10 | Thin/Divergent | 60.0 | 40.0 | 60.0 | 0.0 | 0.0 |

| changepoint_date |

|---|

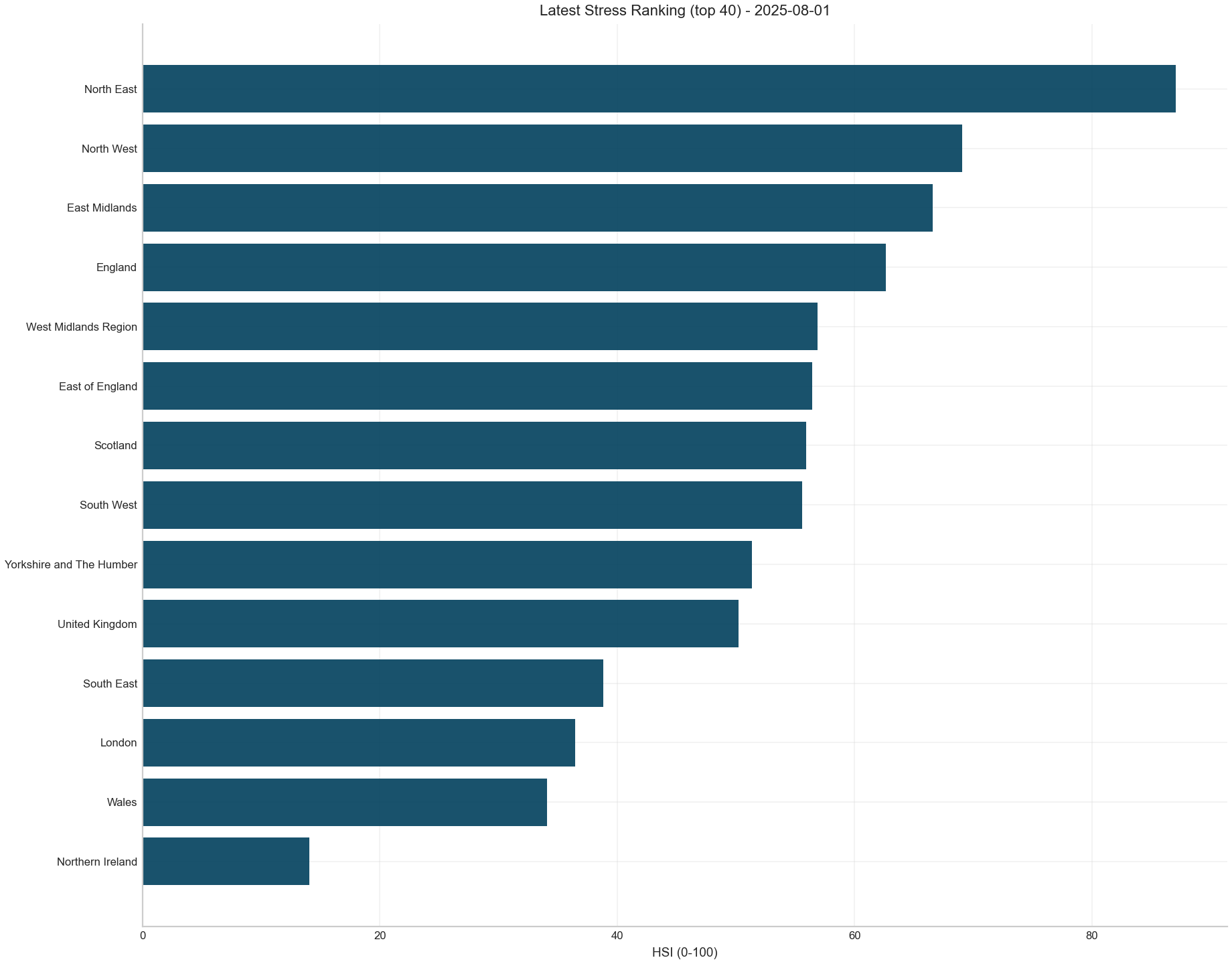

| Date | AreaCode | RegionName | hsi_0_100 | hsi_change_1m | hsi_change_3m | hsi_change_6m | hsi_change_12m | stress_flags_total | pct_12m | sales_volume_yoy_pct | top_drivers |

|---|---|---|---|---|---|---|---|---|---|---|---|

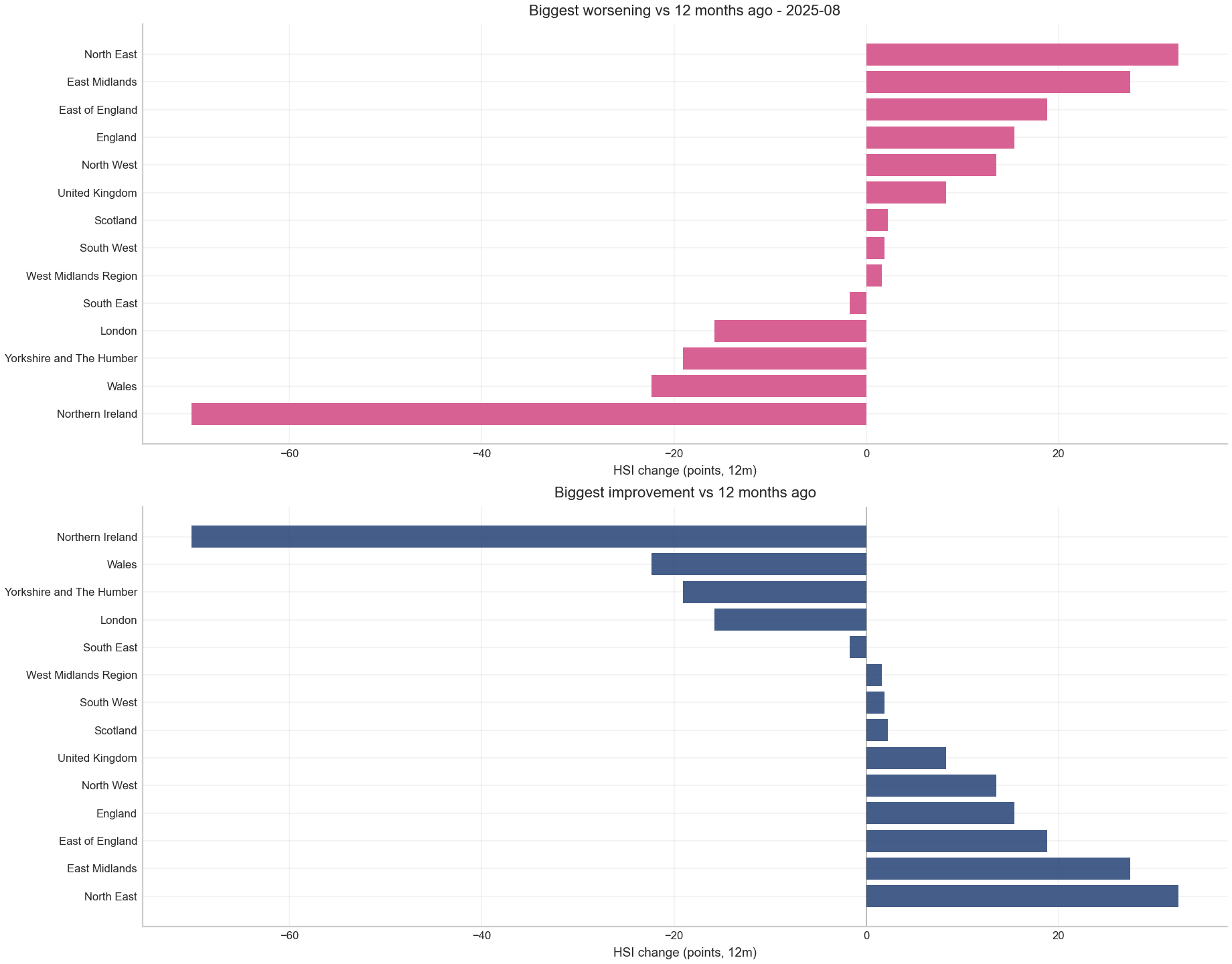

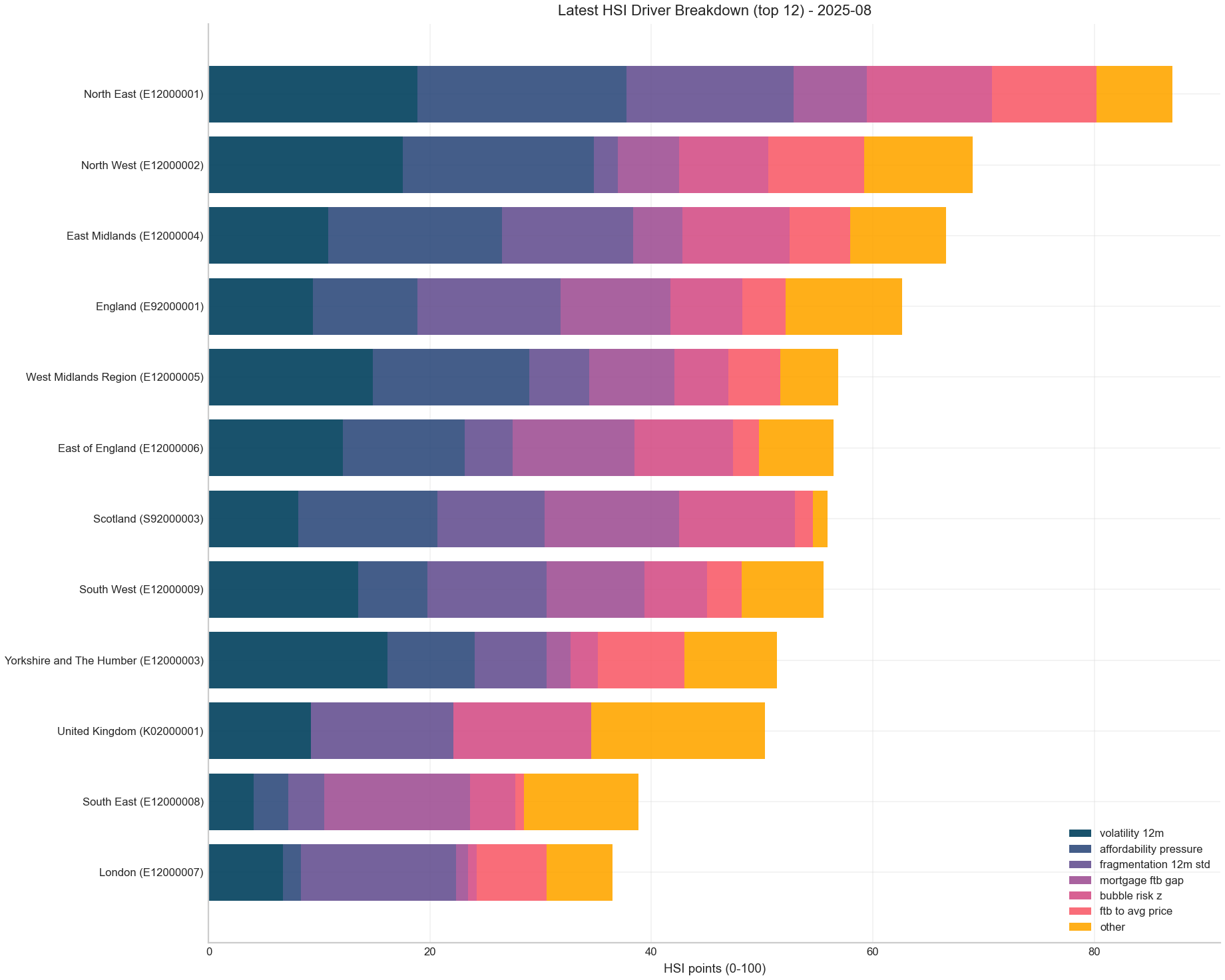

| 2025-11 | E12000001 | North East | 83.827 | -3.347 | -2.959 | 20.355 | 7.637 | 3 | 6.8 | NaN | Affordability pressure (18.9), Volatility (18.9), Property-type fragmentation (12.9) |

| 2025-11 | E12000003 | Yorkshire and The Humber | 66.936 | -0.764 | 9.117 | -1.043 | 1.656 | 1 | 3.7 | NaN | Volatility (16.2), Affordability pressure (14.2), Property-type fragmentation (11.9) |

| 2025-11 | N92000002 | Northern Ireland | 66.014 | 9.217 | 29.491 | 29.828 | 5.232 | 0 | 7.1 | NaN | Volatility (25.3), Bubble risk (z-score) (16.6), Monthly shock (abs z) (12.0) |

| 2025-11 | E12000002 | North West | 62.624 | -2.269 | -7.145 | 4.206 | 4.453 | 1 | 4.1 | NaN | Volatility (17.5), Affordability pressure (15.7), FTB vs average price (8.6) |

| 2025-11 | E92000001 | England | 58.266 | 4.605 | 4.165 | 2.833 | 6.841 | 3 | 2.2 | NaN | Property-type fragmentation (14.0), Affordability pressure (11.0), Mortgage vs FTB price gap (9.9) |

| 2025-11 | E12000009 | South West | 55.907 | 6.447 | 17.039 | 8.941 | 9.082 | 1 | 1.9 | NaN | Bubble risk (z-score) (8.9), Mortgage vs FTB price gap (8.8), Affordability pressure (8.6) |

| 2025-11 | E12000006 | East of England | 53.077 | -2.201 | -5.136 | -7.741 | 14.583 | 2 | 1.8 | NaN | Volatility (12.1), Mortgage vs FTB price gap (11.0), Bubble risk (z-score) (8.1) |

| 2025-11 | E12000004 | East Midlands | 52.650 | -4.605 | -17.499 | -0.172 | 15.094 | 3 | 2.7 | NaN | Affordability pressure (12.6), Volatility (10.8), Property-type fragmentation (9.7) |

| 2025-11 | S92000003 | Scotland | 52.336 | 1.527 | 9.241 | 5.156 | -16.223 | 0 | 4.5 | NaN | Affordability pressure (17.3), Mortgage vs FTB price gap (12.1), Bubble risk (z-score) (11.3) |

| 2025-11 | E12000005 | West Midlands Region | 42.902 | -13.522 | -11.531 | -12.014 | -8.596 | 2 | 2.1 | NaN | Volatility (13.5), Affordability pressure (8.6), Mortgage vs FTB price gap (7.7) |

| 2025-11 | E12000007 | London | 42.677 | 4.582 | -5.280 | -13.672 | -6.589 | 3 | -1.2 | NaN | Property-type fragmentation (15.1), Monthly shock (abs z) (7.5), Drawdown from 36m peak (5.7) |

| 2025-11 | E12000008 | South East | 40.970 | 0.427 | 5.654 | -6.911 | -6.442 | 1 | 1.0 | NaN | Mortgage vs FTB price gap (13.2), Monthly shock (abs z) (6.5), Property-type fragmentation (5.4) |

| 2025-11 | K02000001 | United Kingdom | 38.479 | 1.152 | -1.548 | -0.874 | -12.734 | 2 | 2.5 | NaN | Property-type fragmentation (14.7), Bubble risk (z-score) (9.7), Volatility (6.9) |

| 2025-11 | W92000004 | Wales | 35.198 | 3.055 | -10.188 | -15.233 | -18.934 | 1 | 0.7 | NaN | Property-type fragmentation (10.8), FTB vs average price (7.1), Monthly shock (abs z) (4.3) |

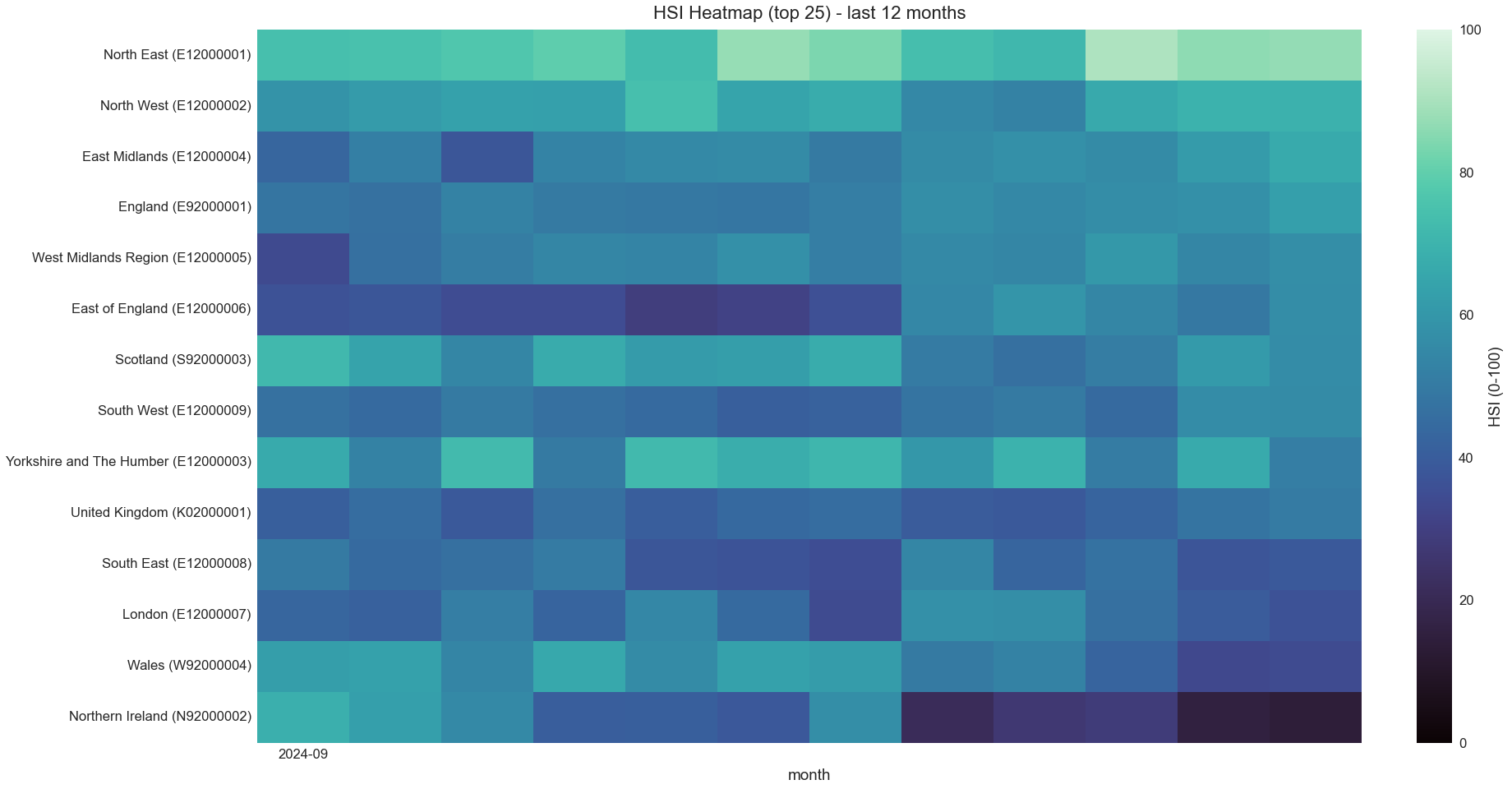

| month | AreaCode | RegionName | 2025-06 | 2025-07 | 2025-08 | 2025-09 | 2025-10 | 2025-11 | change_1m | change_3m |

|---|---|---|---|---|---|---|---|---|---|---|

| E12000001 | North East | 84.972 | 78.253 | 86.787 | 74.752 | 87.174 | 83.827 | -3.347 | -2.959 | |

| E12000002 | North West | 67.341 | 70.170 | 69.769 | 60.787 | 64.892 | 62.624 | -2.269 | -7.145 | |

| E12000003 | Yorkshire and The Humber | 57.383 | 60.778 | 57.819 | 60.235 | 67.700 | 66.936 | -0.764 | 9.117 | |

| E12000004 | East Midlands | 51.243 | 62.676 | 70.149 | 50.500 | 57.255 | 52.650 | -4.605 | -17.499 | |

| E12000005 | West Midlands Region | 59.044 | 56.578 | 54.433 | 62.236 | 56.424 | 42.902 | -13.522 | -11.531 | |

| E12000006 | East of England | 53.805 | 46.863 | 58.213 | 52.414 | 55.279 | 53.077 | -2.201 | -5.136 | |

| E12000007 | London | 50.009 | 46.897 | 47.958 | 48.193 | 38.095 | 42.677 | 4.582 | -5.280 | |

| E12000008 | South East | 43.023 | 48.683 | 35.317 | 44.157 | 40.544 | 40.970 | 0.427 | 5.654 | |

| E12000009 | South West | 49.560 | 42.417 | 38.869 | 45.540 | 49.461 | 55.907 | 6.447 | 17.039 | |

| E92000001 | England | 56.824 | 59.428 | 54.101 | 57.884 | 53.661 | 58.266 | 4.605 | 4.165 | |

| K02000001 | United Kingdom | 40.970 | 45.013 | 40.027 | 43.666 | 37.327 | 38.479 | 1.152 | -1.548 | |

| N92000002 | Northern Ireland | 34.569 | 28.976 | 36.523 | 39.151 | 56.797 | 66.014 | 9.217 | 29.491 | |

| S92000003 | Scotland | 51.454 | 45.614 | 43.095 | 48.446 | 50.809 | 52.336 | 1.527 | 9.241 | |

| W92000004 | Wales | 38.267 | 45.032 | 45.386 | 53.778 | 32.143 | 35.198 | 3.055 | -10.188 |

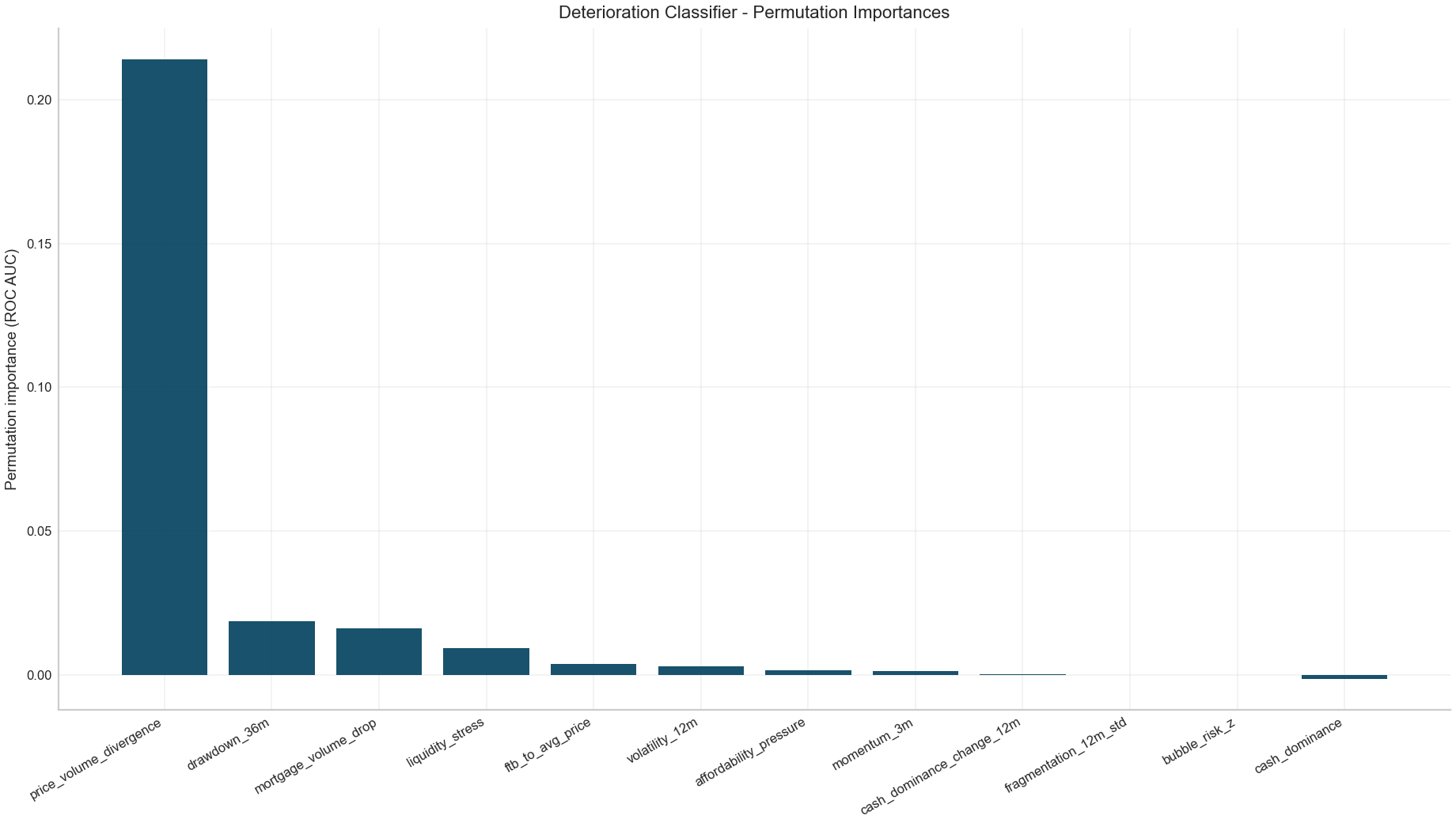

| train_rows | test_rows | cutoff_date | test_months | accuracy | precision | recall | roc_auc |

|---|---|---|---|---|---|---|---|

| 378 | 126 | 2025-02-01 | 9 | 0.746 | 0.584 | 1.0 | 0.802 |

| Date | AreaCode | RegionName | hsi_0_100 | deterioration_risk |

|---|---|---|---|---|

| 2025-11 | E12000001 | North East | 83.827 | 0.0 |

| 2025-11 | E12000002 | North West | 62.624 | 0.0 |

| 2025-11 | E12000003 | Yorkshire and The Humber | 66.936 | 0.0 |

| 2025-11 | E12000004 | East Midlands | 52.650 | 0.0 |

| 2025-11 | E12000005 | West Midlands Region | 42.902 | 0.0 |

| 2025-11 | E12000006 | East of England | 53.077 | 0.0 |

| 2025-11 | E12000007 | London | 42.677 | 0.0 |

| 2025-11 | E12000008 | South East | 40.970 | 0.0 |

| 2025-11 | E12000009 | South West | 55.907 | 0.0 |

| 2025-11 | E92000001 | England | 58.266 | 0.0 |

| 2025-11 | K02000001 | United Kingdom | 38.479 | 0.0 |

| 2025-11 | N92000002 | Northern Ireland | 66.014 | 0.0 |

| 2025-11 | S92000003 | Scotland | 52.336 | 0.0 |

| 2025-11 | W92000004 | Wales | 35.198 | 0.0 |

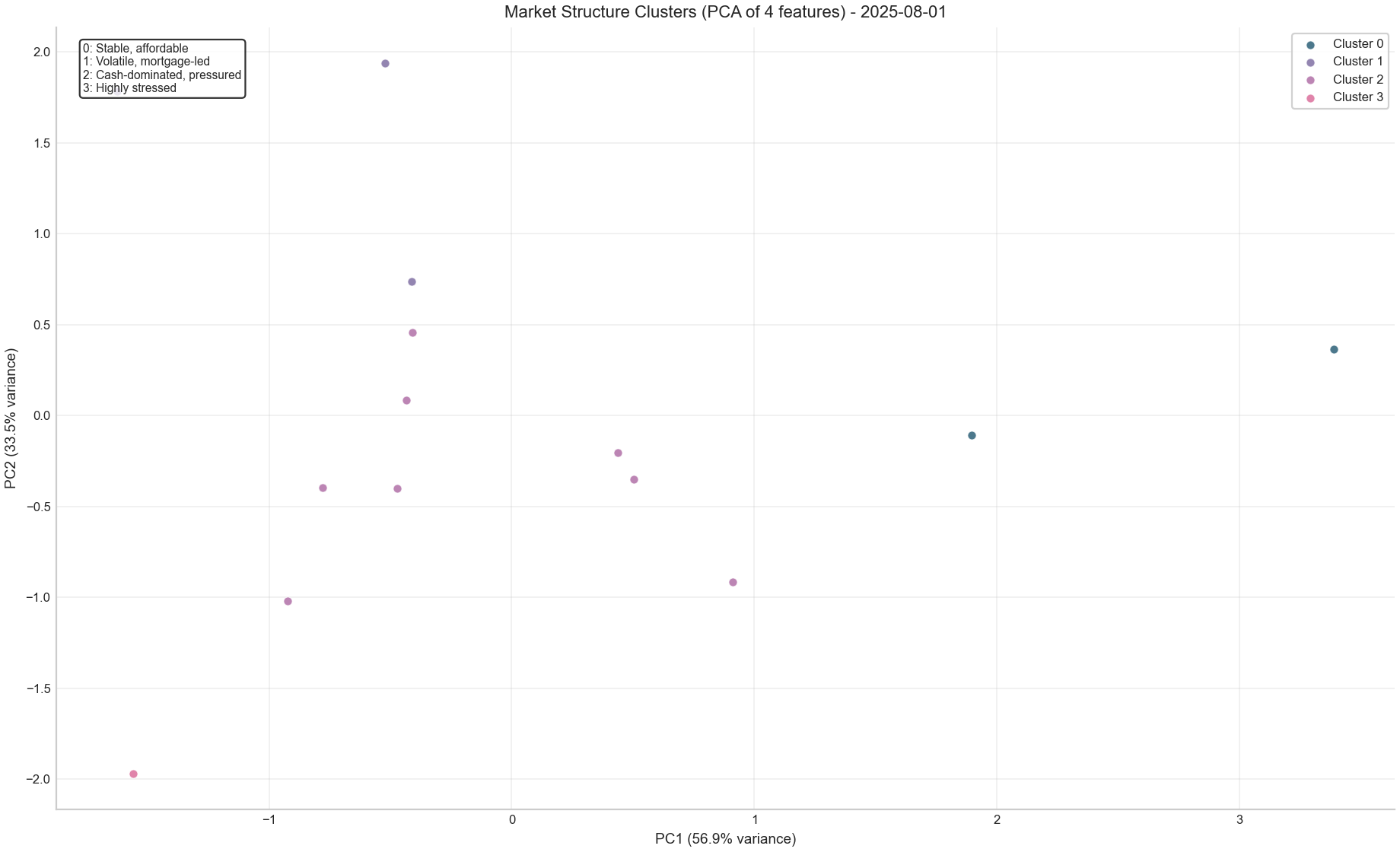

| Date | AreaCode | RegionName | cluster | affordability_pressure | volatility_12m | cash_dominance | mortgage_ftb_gap |

|---|---|---|---|---|---|---|---|

| 2025-11-01 | E12000004 | East Midlands | 0 | -1.2 | 1.395 | NaN | 0.172 |

| 2025-11-01 | E12000006 | East of England | 0 | -2.3 | 1.400 | NaN | 0.226 |

| 2025-11-01 | E92000001 | England | 0 | -1.8 | 1.373 | NaN | 0.216 |

| 2025-11-01 | N92000002 | Northern Ireland | 0 | NaN | 1.802 | NaN | NaN |

| 2025-11-01 | E12000009 | South West | 0 | -1.9 | 1.267 | NaN | 0.205 |

| 2025-11-01 | K02000001 | United Kingdom | 0 | NaN | 1.109 | NaN | NaN |

| 2025-11-01 | E12000005 | West Midlands Region | 0 | -1.9 | 1.559 | NaN | 0.185 |

| 2025-11-01 | E12000001 | North East | 1 | 2.7 | 3.319 | NaN | 0.178 |

| 2025-11-01 | E12000002 | North West | 1 | 0.4 | 2.742 | NaN | 0.178 |

| 2025-11-01 | E12000003 | Yorkshire and The Humber | 1 | 0.1 | 2.508 | NaN | 0.163 |

| 2025-11-01 | E12000007 | London | 2 | -5.7 | 1.143 | NaN | 0.158 |

| 2025-11-01 | W92000004 | Wales | 2 | -3.0 | 0.675 | NaN | 0.165 |

| 2025-11-01 | S92000003 | Scotland | 3 | 0.8 | 1.201 | NaN | 0.260 |

| 2025-11-01 | E12000008 | South East | 3 | -3.0 | 0.800 | NaN | 0.277 |

| feature | label | weight | meaning |

|---|---|---|---|

| affordability_pressure | Affordability pressure | 1.0 | FTB 12m% change minus wage growth proxy; higher means affordability worsening. |

| liquidity_stress | Low sales volume | 1.0 | Low historical sales volume percentile (1.0 = worst); higher means thinner market liquidity. |

| volatility_12m | Volatility | 1.0 | Rolling 12-month standard deviation of monthly price changes; higher means more unstable pricing. |

| fragmentation_12m_std | Property-type fragmentation | 0.8 | Dispersion of 12m% changes across property types; higher means a segmented market. |

| mortgage_volume_drop | Mortgage volume drop (YoY) | 0.8 | -(mortgage sales volume YoY%); higher means mortgage activity falling faster. |

| price_volume_divergence | Price-volume divergence | 0.8 | Price YoY% minus volume YoY%; high values can mean prices up on falling liquidity. |

| mortgage_ftb_gap | Mortgage vs FTB price gap | 0.7 | MortgagePrice / FTBPrice - 1; higher means financed buyers are paying a larger premium over FTB segment. |

| bubble_risk_z | Bubble risk (z-score) | 0.6 | Z-score of YoY price change vs long-run baseline; high values indicate unusually hot growth for that area. |

| cash_dominance | Cash dominance | 0.6 | CashSalesVolume / (CashSalesVolume + MortgageSalesVolume); higher suggests mortgage constraints or cash-driven pricing. |

| cash_dominance_change_12m | Cash dominance change (12m) | 0.6 | Change in cash dominance vs 12 months ago; rising implies worsening mortgage conditions. |

| repossession_rate_12m_per_1000_sales | Repossession rate (12m per 1k sales) | 0.6 | Repossession 12m sum / sales volume 12m sum * 1000; higher suggests rising financial distress. |

| ftb_to_avg_price | FTB vs average price | 0.5 | FTBPrice / AveragePrice; higher means first-time buyers are paying closer to the overall average. |

| new_old_premium | New vs old premium | 0.4 | NewPrice / OldPrice - 1; higher means new builds are priced at a larger premium. |

| shock_1m_abs_z | Monthly shock (abs z) | 0.4 | Absolute z-score of the 1m% change vs recent history; higher means a more unusual monthly move. |

| drawdown_36m | Drawdown from 36m peak | 0.3 | (rolling peak - level) / rolling peak over 36m; higher means larger retreat from recent peak. |